The future is simple, convenient, freeing and most importantly, wireless. We are currently experiencing a world transitioning from a complicated web of wires into a clutter-free wireless environment. Though we’ve already had a taste of the wireless world via WiFi, Bluetooth and IoT tech and gadgets, the best is yet to come. In the next…

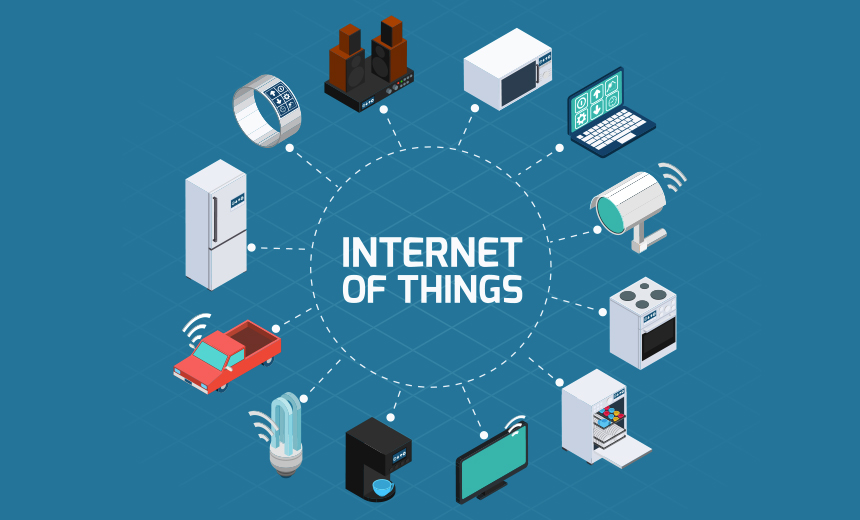

5 Wireless Technologies Behind The Success Of IoT

The Internet of Things (IoT) refers to a wireless network of devices which can communicate with each other using the internet. IoT does not include only the smart devices such as smartphones and computers, but also aims to encompass traditional household appliances such as washing-machines and air-conditioners as well. The aim of such networking is…

2 Amazing HP Wireless Printers That You Can Comfortably Carry In Your Pocket

If you are after a stylish, user-friendly, and affordable home printer you have to try HP wireless printers. Despite being cost effective and dependable, they will give you quality work. There is a wide range variety available for home both home and business needs. With the increased advancement in technology, there is a new and…

Wireless Technology Trends

Wireless technology is everywhere and it changes every now and then. It is the new trend. In an office setting, you must have Wi-Fi, as this will help improve productivity of your employees. It will also help you improve on the services you offer your customers. You need this technology on Bluetooth, mobile printers, and…

Wireless Communication Technologies Types and Advantages

The terminology wireless holds a reference to the transmission of information or communication over distance and in the absence of cables, wires, or any other conductors as such. This happens to be one of the most significant media for data transmission to other devices. The communication gets set and subsequently, information gets transmitted through air,…

Is Wi-Fi Enuogh For Streaming of 4K Ultra Def? Tiny4K Test!

Tiny4k is THE place to go to if you wish to view hot women fulfilling their fantasies–and getting filled in the process. The site itself is professionally done, the layout is simple and intuitive allowing the user quick navigation. The splash page itself focuses on what all adult sites should do best, provide content–and lots of it.

Awesome Wi-Fi Facts You Probably Did Not Know

WiFi happens to be a technology that makes use of radio waves for transferring information from one electronic device to another. WiFi has become an integral part of our daily lives. It is strange as a majority of us have a limited understanding of what it is. Here are few surprising facts about WiFi. …

PrincessCum – Girls Trying To Seduce Their Partners With Internal Mess!

When you are done a favor by a girl from https://princesscum.com, just have it at the back of your mind that you have to return the favor back. In most cases, the favor has to be returned back by wild sex and deeply cumming inside her.

Wireless Technologies Improvising the World of Computers

The improvisation in the modern technology has been something that has changed everyday lives of people, the wireless technology being one of them. It has not been much time that the wireless technology has been introduced but the gaining popularity has been pretty quick and responsive. According to research and statistics, it has been found…

Wi-Fi Trends: A Twist on Fake Driver’s Education

This will be a tricky question. Do you know what is Wi-Fi mostly used for? Yup, you guessed it. To download adult-rated materials from Internet. We review the most famous FakeDrivingSchool website. Is it worth the bandwidth? In one word – YES! Read our article.